California Retirement Planning

Golden Financial Compass

History of Golden Financial Compass

Golden Financial Compass was founded to guide individuals and families toward financial security and peace of mind. The company’s name reflects a deeply personal journey, inspired by the compass that symbolized hope and direction during an escape from Vietnam. This experience shaped the company’s commitment to trust, integrity, and thoughtful financial planning.

Since its inception, Golden Financial Compass has become a trusted provider of financial services, offering solutions in life insurance, health insurance, annuities, 401(k) rollovers, and pension management. Co-founders Theresa Nguyen and James Nguyen brought together their expertise to create a company dedicated to helping clients achieve financial confidence and stability.

Mission and Values

Our mission is to provide financial security and peace of mind through reliable, customized solutions. We are guided by these core values:

Integrity: Acting with honesty and transparency.

Commitment: Serving clients’ best interests at every step.

Empathy: Listening and caring about clients’ needs.

Excellence: Striving for the highest standards.

Innovation: Embracing new tools and strategies.

Retire with confidence

Our Planning Process

Our three-step planning process works to help identify and implement suitable financial strategies for helping our clients meet their needs and achieve their goals and objectives for retirement.

How We Work with Clients

At Golden Financial Compass, we build lasting relationships by understanding each client’s unique needs and goals. Through personalized consultations, we develop tailored strategies and present clear options. Our emphasis on education ensures clients feel empowered and informed every step of the way.

We combine innovative financial tools with a compassionate approach to protect and grow wealth while adapting to life’s changes. Our ongoing support ensures that clients’ plans remain aligned with their evolving circumstances.

Brief Overview of Life, Annuity, and Health Insurance Products

Life Insurance: Protect loved ones and leave a legacy with plans tailored to your needs, including term and whole life insurance.

Annuities: Ensure a stable retirement income with options like fixed and indexed annuities for financial peace of mind.

Health Insurance: Access quality healthcare with plans for individuals, families, and Medicare supplements, ensuring comprehensive coverage.

At Golden Financial Compass, we are your trusted partner in navigating life’s financial milestones with clarity and care.

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

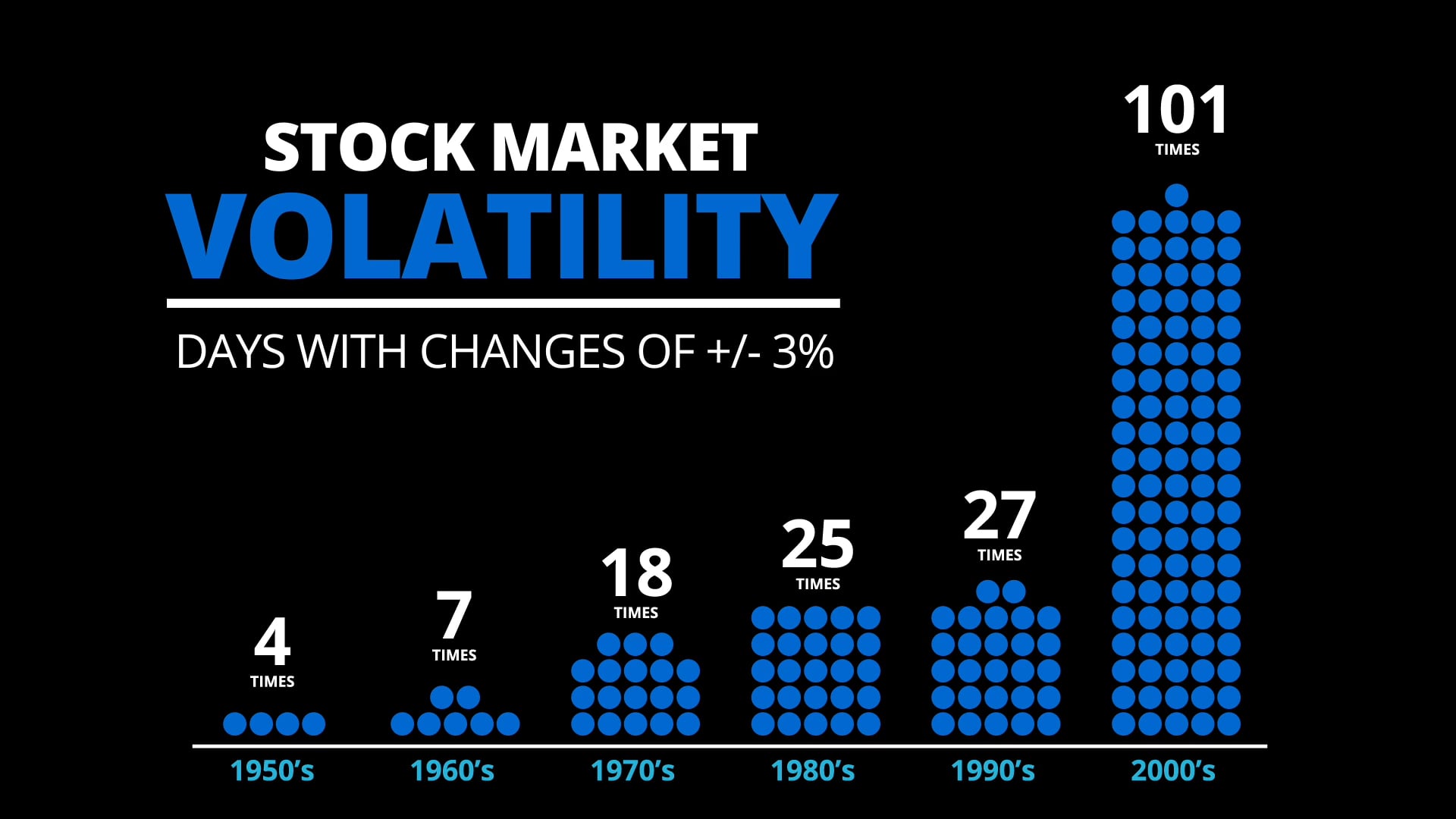

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Educational Events

Events in January 2026

- There are no events scheduled during these dates.

Client Events

Events in January 2026

- There are no events scheduled during these dates.

Our Downloads

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.